Name:HENAN GUANGDA TEXTILES IMP. & EXP. CO., LTD.

Add:10/F,XinMangGuo Building,No.9 Business Outer Ring Road,ZhengDong New District,ZhengZhou,China

Tel:86-371-60170260

Fax:0371-60136222

Postcode:450000

Web:www.hngdtex.com

The global textile industry, a major contributor to many countries' Gross Domestic Product (GDP), is now facing intensified scrutiny regarding its environmental and social impacts. As the largest manufacturing sector by production volume and workforce, it is also one of the most resource-intensive and polluting industries. Growing consumer awareness and demand for sustainable practices are driving efforts to enhance sustainability in textile production and consumption.

While the EU and the USA are leading the way with progressive sustainability policies, major textile producers in Asia—such as Bangladesh, Vietnam, and India—face significant challenges in implementing sustainable practices and increasing resource efficiency. These challenges are primarily due to resource constraints and limited access to innovative technologies. This paper explores the difficulties associated with managing the textile waste value chain and evaluates sustainable processes and technologies aimed at promoting a cleaner environment.

Overview of Textile Industries in Major Global Manufacturers

The global textile industry can be categorised into two main segments: the demand side and the supply side. On the supply side, countries in Asia—such as India, Bangladesh, Vietnam, and Cambodia—play a dominant role, while the United States also maintains a significant presence, particularly in specialised areas. Although there are differences in expertise, with the US focusing more on technical textiles, the European Union and Asian countries are heavily involved in garment production and textile manufacturing. The demand side is mainly controlled by the US and the EU, other than Canada, Japan, etc.

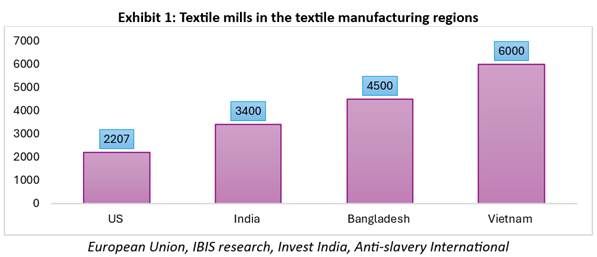

Traditionally the Asian Region is the major supplier of textiles and apparel to the world. Statistics indicate that Asian regions have a higher concentration of textile mills compared to the United States. Given this disparity, these textile-major economies must adopt and implement sustainability policies to ensure long-term viability and environmental responsibility within the industry.

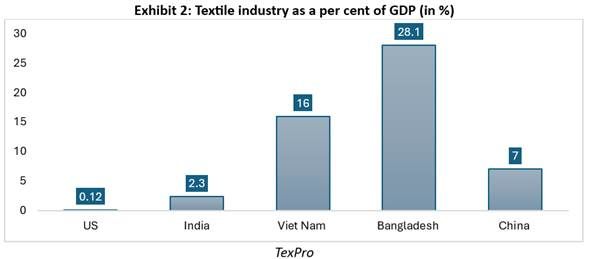

When examining the contribution of the textile industry to the economies of major textile-producing countries, Bangladesh and Vietnam stand out with significant contributions to their GDPs. Bangladesh, a global powerhouse in apparel production, sees its textile industry contribute around 28 per cent to the nation's GDP, while Vietnam contributes about 16 per cent. In contrast, India, despite its large labour force (about 45 million) employed in the textile sector, has a much smaller contribution of only 2.3 per cent to its GDP. However, these nations face significant challenges related to recycling and textile waste disposal, which remain major environmental concerns.

Recycling Challenges

All textile industries in their respective nations must implement sustainability policies. However, a gap exists between the proposal and implementation of these policies in manufacturing versus importing nations. For instance, the EU has developed an exemplary policy for circularity in the textile value chain. Key policies such as the European Green Deal and the Circular Economy Action Plan set ambitious targets for reducing emissions, increasing resource efficiency, and promoting recycling and reuse. The EU has also introduced specific regulations targeting the textile sector, such as restrictions on hazardous substances and requirements for extended producer responsibility (EPR). Despite this, it is essential to critically assess the recycling methods adopted by these nations to ensure they align with sustainability goals.

The problem of textile waste generation is particularly acute in major textile economies in Asia, such as Bangladesh, Vietnam, and India. In Bangladesh, while many textile manufacturing units hold US certifications for maintaining safe and secure workplaces, the conditions in textile sorting and recycling facilities are often far less secure. According to a Chatham House report on Bangladesh’s sorting economy, women predominantly work in this sector, yet they face unsafe working conditions and low wages. Despite these challenges, Bangladesh’s sorting economy plays a crucial role in reducing greenhouse gas emissions, saving around 240 tonnes annually.

India, meanwhile, has a long-established, albeit technologically outdated, recycling system that dates back to the 1990s. Although this system needs modernisation, India manages to process not only its textile waste but also imports waste from other countries for recycling.

Vietnam, on the other hand, generates significant amounts of textile waste, but its recycling ecosystem is entirely unorganised, lacking any formal structure. As a result, Vietnam exports a considerable portion of its textile waste to countries like India for processing.

Several challenges within the textile waste economy often go unaddressed. Key among these is the lack of recognition and formalisation of the sector, which hinders access to essential resources such as financing, policy support, and other benefits. Formalising the sector could unlock these opportunities, fostering greater sustainability and efficiency.

Sourcing and procurement challenges: All the waste handlers in India, Bangladesh, Vietnam, and Africa face a huge problem of procurement of goods. At times, the cost at which the waste is imported is huge and the value chain overall, gives less or no margins to the collectors and aggregators, leading to them not having criteria as to what type and material of waste to import to ensure that they will not lose out on the opportunities.

Transportation and warehousing: There is a huge cost of transportation and the warehouse that can be potentially used to sort and further process the waste. Given these reasons, in the entire Asian region, almost all the regions in Asia have these waste management value chains run informally.

Lack of recognition as a formal sector: Given the fact that the textile waste ecosystem is informal, there is a reason for this. Governments across the globe do not fully recognise the sector as a formal occupation or a business, owing to which, they are unable to access bank loans and policy benefits

Policy coverage: As sustainability as an issue has started to gain ground, governments across the world now have started to frame policies and benefits. Although the sector stays largely informal, the policies have now started to play a huge role. However, it will take time to completely formalise the industry.

Challenges in the Textile Waste Collection Value Chain

Although the efforts done by the components of the supply chain are appropriate enough, there are the following shortcomings in the entire system:

Collection

The collection efforts for textile waste are fragmented across the value chain, with household textile waste collection being particularly disjointed in many countries. While Australia, the EU, and the US have recently begun to implement laws regarding textile waste collection, these initiatives are still in their early stages. The lack of comprehensive policy actions and incentives for textile waste collection has resulted in many take-back programs and used apparel re-collection initiatives closing down prematurely. Additionally, many charities are forced to discard the textiles and apparel they collect due to inadequate sorting facilities and infrastructure. To address these challenges, a well-structured system for the collection and processing of used apparel is urgently needed.

Sorting

Once garments have been collected, sorting becomes the next critical challenge in the circularity chain. It remains unclear whether apparel should be sorted by fibre type, level of damage, or through a composite method. Effective sorting requires substantial infrastructure, including significant capacity and a robust transportation system to move clothing from collection points to sorting facilities, and then to recycling centres.

Often, even when dedicated sorting systems exist, the infrastructure needed to transport sorted clothes to recycling facilities is inadequate. Additionally, since the sorting process is highly labour-intensive, garment labels play a crucial role in identifying and directing items for appropriate recycling. Therefore, establishing clear pre-conditions for sorting apparel is essential to ensure efficiency and effectiveness in the recycling process.

Recycling

The current recycling model for apparel often falls short of achieving true closed-loop recycling. The feasibility of recycling various fibre types and the longevity of apparel manufactured using traditional methods are still uncertain. Additionally, products resulting from closed-loop recycling have struggled to gain market traction due to their high cost and questionable quality.

For example, mechanical recycling, one of the most expensive recycling methods, requires mono-material, undyed apparel, making the sorting and sourcing of such materials costly for recyclers. This method is also known to weaken the fibres, reducing the durability of the resulting apparel. Moreover, garments produced through mechanical recycling often incorporate virgin fibres, which increases production costs and diminishes the sustainability of the process.

While closed-loop recycling primarily produces polyester and other fibres, it attempts to address some of the limitations of mechanical recycling. However, this method is also highly expensive, requiring significant investment and capacity to be viable in the long term. As a result, the sustainability and economic feasibility of closed-loop recycling remain challenges that need to be addressed.

Textile Waste Statistics by Country

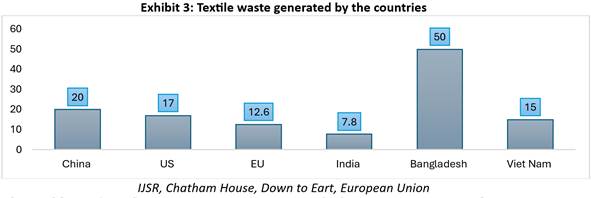

The global textile and fashion industry faces a significant challenge with the disposal of clothing. Currently, only 15 per cent of discarded garments are collected for recycling, and just 1 per cent of those are recycled into new clothing. If fast fashion continues unchecked, global textile consumption is projected to rise by approximately 120 million tonnes by 2030. This presents a stark picture of the industry's recycling practices.

Textile production is a major environmental concern, responsible for 20% of clean water pollution and ranking as the third-largest contributor to land pollution as of 2020, according to the European Parliament. The industry also accounts for 7 per cent of global CO2 emissions, emitting around 1.7 billion tons of CO2 annually. In response, the US and EU are leading efforts to implement regulations across the textile and apparel value chain. Notable policies include the Extended Producer Responsibility (EPR) Act and third-party certifications, which aim to enhance accountability in apparel production and standardise pollution metrics.

Despite these efforts, the industry incurs nearly $500 billion in losses due to underutilisation of apparel and inadequate recycling practices. Among the top textile-producing countries, China, the US, and the EU are also the largest contributors to textile waste, with China alone discarding approximately 20 million tons.